Tbilisi Residential Real Estate

March 2025 overview

Summary

Demand in Tbilisi residential real estate market remained sluggish, suggesting reserved buyer sentiment. On the supply side, construction permit issuance moderated in 1Q25. While prices continue to rise on the primary market, the pace of growth has slowed in recent months compared to 2024.

Demand

In Mar-25, the number of sold apartments in Tbilisi, according to the Public Registry, stood at 3,078 units, up by 2.9% y/y, of which:

• Sales on the secondary market, which show real-time dynamics, fell by 2.9% y/y.

• Sales on the primary market, where data are impacted by delayed registrations, increased by 9.8% y/y, reflecting a one-off effect from the late registrations of previously sold apartments in several projects.

Our real-time survey of developers, which captures current trends on primary market, mirrors the secondary market trend, showing a 11.3% y/y reduction in the number of sold apartments in Mar-25.

In total, 9,286 apartments were sold in Tbilisi in 1Q25, bringing the residential market value to US$ 671.7mn (-1.1% y/y).

Supply

Permit issuance has regained momentum following the Jan-25 slowdown. In Mar-25, 17 residential construction permits were issued, with total living area reaching 160,975 m2 (+7.3% y/y). Overall, permit issuance in 1Q25 was down 7.4% y/y, yet still elevated compared to levels recorded before 2023.

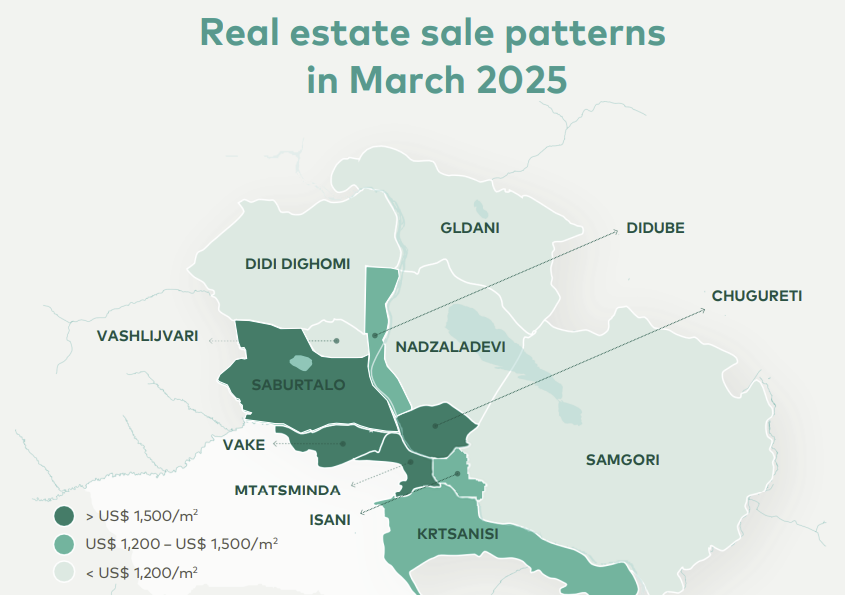

Prices

In Mar-25, the primary market average price per square meter rose by 0.4% m/m, reaching US$1,330. In contrast, the average price on the secondary market (for new buildings built with permits issued after 2013) declined for the 2nd month in a row, falling by 1.9% m/m to US$1,220.

Rents

In Mar-25, price for renting an average apartment (50-60 m2 ) in Tbilisi decreased slightly by 0.3% m/m to US$ 9.5 per m2 . Rental yield was 8.6%.

Published by IARE.ORG.GE

Source Galt & Taggart

Summary

Demand in Tbilisi residential real estate market remained sluggish, suggesting reserved buyer sentiment. On the supply side, construction permit issuance moderated in 1Q25. While prices continue to rise on the primary market, the pace of growth has slowed in recent months compared to 2024.

Demand

In Mar-25, the number of sold apartments in Tbilisi, according to the Public Registry, stood at 3,078 units, up by 2.9% y/y, of which:

• Sales on the secondary market, which show real-time dynamics, fell by 2.9% y/y.

• Sales on the primary market, where data are impacted by delayed registrations, increased by 9.8% y/y, reflecting a one-off effect from the late registrations of previously sold apartments in several projects.

Our real-time survey of developers, which captures current trends on primary market, mirrors the secondary market trend, showing a 11.3% y/y reduction in the number of sold apartments in Mar-25.

In total, 9,286 apartments were sold in Tbilisi in 1Q25, bringing the residential market value to US$ 671.7mn (-1.1% y/y).

Supply

Permit issuance has regained momentum following the Jan-25 slowdown. In Mar-25, 17 residential construction permits were issued, with total living area reaching 160,975 m2 (+7.3% y/y). Overall, permit issuance in 1Q25 was down 7.4% y/y, yet still elevated compared to levels recorded before 2023.

Prices

In Mar-25, the primary market average price per square meter rose by 0.4% m/m, reaching US$1,330. In contrast, the average price on the secondary market (for new buildings built with permits issued after 2013) declined for the 2nd month in a row, falling by 1.9% m/m to US$1,220.

Rents

In Mar-25, price for renting an average apartment (50-60 m2 ) in Tbilisi decreased slightly by 0.3% m/m to US$ 9.5 per m2 . Rental yield was 8.6%.

Published by IARE.ORG.GE

Source Galt & Taggart